Determinants of Socio-Environmental Reporting of Quoted Companies in Nigeria

Abstract

The quest for sustainability has caused the corporate body to realize that the world is on the brink of a potential crisis from the combined effects of social and environmental damages. This study examined the determinants of socio-environmental accounting of listed firms in Nigeria. This was with a view to providing information on how socio-environmental accounting could be employed to enhance firms’ sustainability. Secondary source of data collection was employed for the study. Purposive sampling technique was used to select a sample of 50 firms listed on the main board of the Nigerian Stock Exchange based on availability of their annual reports from 2005 to 2013. Qualitative data were sourced through the use of checklist. Data collected were analysed with the aid of descriptive statistics such as; mean, median; and inferential statistics using ordinary least square regression analysis. The study found that firms size (t=10.3263; p˂0.05) profitability (t=7.6913; p˂0.05) and number of analysts analyzing the firms (t=2.4684; p˂0.05) were the three major factors that had positive influence on socio-environmental reporting of listed firms in Nigeria. However, socio-environmental performance had significant (t=-3.3508; p˂0.05) negative influence on socio-environmental reporting in Nigerian quoted companies. The study concluded that socio-environmental accounting could be employed to enhance sustainable business practice in quoted companies.Downloads

References

ACCA (2004). Report Summary: The State of Corporate Environmental and Social Reporting in Malaysia 2004. Kuala Lumpur, ACCA Malaysia Sdn. Bhd.: 1 - 25.

ACCA (2004). Towards Transparency: Progress on Global Sustainability Reporting. London: Certified Accountants Education Trust.

ACCA, AccountAbility and KPMG (2009). Accounting Sustainability Briefing: ACCAUK.

ACCA, FAUNA & FLORA International and KPMG (2012). An evaluation of the relevance of biodiversity and ecosystem services to accountancy professionals and the private sector: www.flogo-design.co.uk.

Aerts, W. and Cormier, D. (2009). “Media Legitimacy and Corporate Environmental Communication”. Accounting, Organizations and Society, 34 (1), 1-27.

Basamalah, A. S. and Jermiah, J. (2005). Social and Environmental Reporting and Auditing in Indonesia: Main Training organisational Legitimacy? Gadjah Mada International Journal of Business, 7(1), 109– 127.

Belkaoui, A. and Karpic, P. G. (1989). “Determinants of the Corporate Decision to Disclose Social Information”. Accounting, Auditing, and Accountability Journal,2 (1), 36-51.

Buhr, N. (2001). “Corporate silence: environmental disclosure and the North American free trade agreement”. Critical Perspective on Accounting, 12 (3), 405-421.

Cahan, S. F. (1992). The effect of antitrust investigations on discretionary accruals: Arefined test of the political-cost hypothesis. The Accounting Review, 67(1), 77-95. Cahan, S. F., Chavis, B. M. and Elmendorf, R. G. (1997). Earnings management of chemical firms in response to political cost from environmental legislation. Journal of Accounting, Auditing and Finance, 12(1), 37-65.

Campbell, D., Craven, B. and Shrives, P. (2003). “Voluntary social reporting in three FTSE sectors: a comment on perception and legitimacy”. Accounting, Auditing and Accountability Journal, 18(4), 3-19.

Campbell, D. (2009). Risk and environmental auditing. ACCA student accountant.

Chan, N. (1996). A stakeholder theory perspective to Corporate Environmental Disclosures, Journal of Contemporary Business, vol. 3 No. 3, pp 27-33.

Clarkson, P., Li, Y., Richardson, G.D. and Vasvari, F.P. (2008). “Revisiting the Relation between Environmental Performance and Environmental Disclosure: An Empirical Analysis”. Accounting, Organizations and Society 33, 303-327.

Clause, H. and Richardson, P., (2008). “Experience and Novice Investors: Does Environmental Information influence investment Allocation Decisions”. European Accounting Review, 22, 4-17.

Cochran, P. and Wood, R. (1984). “Corporate Social Responsibility and Financial Performance”. Academy of Management Journal, 7, 42-56.

Collins, C. N. (2009). “Environmental Responsibility and Firm Performance: Evidence from Nigeria”. International Journal of Human and Social Sciences, 4 (6), 2-7.

Cormier, D. and Magnan, M. (2003). “Environmental Reporting Management: A European Perspective”. Journal of Accounting and Public Policy, 22, 43-62.

Cormier, D. and Magnan, M. (2010). “The Informational Contribution of Social and Environmental Disclosures for Investors". Accounting, Auditing & Accountability Journal, 1 (6), 2-39.

Correa-Ruiz, C. And Moneva-Abadía, J. M. (2011). “Special Issue on Social Responsibility Accounting and Reporting in Times of ‘Sustainability Downturn/Crisis”. Revista de Contabilidad-Spanish Accounting Review, 14, 3-21.

Crumbley, D. L. and Mitra, Santanu (2003). Earnings management and politically sensitive environments: another test of corporate response to political costs Accounting and Financial Management Journal, 22(3), 1-24.

Deegan, C. (2000). Financial Accounting Theory. Sydney, McGraw Hill Book Company.

Deegan, C. and Blomquist, C. (2006). “Stakeholder influence on corporate reporting: An exploration of the interaction between WWF-Australia and the Australian minerals industry”. Accounting, Organizations and Society, 31 (4-5), 343-372.

Elijido-Ten, E. (2004). “Determinants of environmental disclosure in a developing country: an application of stakeholder theory”. Paper presented to the Fourth Asia Pacific Interdisciplinary Research in Accounting Conference (APIRA), Singapore, 4th-6th July.

Enahoro, J.A. (2009). Design and Bases of Environmental Accounting in Oil & Gass and Manufacturing Sectors in Nigeria. An Unpublished Ph.D Thesis submitted to the Department of Accounting, Covenant University Ota, Nigeria.

Enyi, P. E. (2012). “Environmental and Social Accounting as an Alternative Approach to Conflict Resolutions In A Volatile and E-Business Environment.” Journal of Sustainable Development and Environmental Protection, 4 (2), 1-7.

Faboyede, O. S. (2011). “Environmental Protection and Sustainability Reporting: Extensible Business Reporting Language (XBRL) Interactive Data to the Rescue”. Journal of Sustainable Development and Environmental Protection, 1 (2), 1-16.

Gray, R. H., Owen, D.L. and Maunders, K.T. (1987). Corporate Social Reporting: Accounting and accountability. Hempstead: Prentice Hall Hemel.

Gray, R., Kouhy, R. and Lavers, S. (1995). “Corporate social and environmental reporting, A review of the literature and a longitudinal study of UK Disclosures”. Accounting, Auditing and Accountability Journal, 8(2), 47-77.

Gray, R., Kouhy, R. and Lavers, S. (1995). “Methodological themes – constructing a research database of social and environmental reporting by UK”. Accounting,Auditing and Accountability Journal, 8 (2), 78-101.

Hasnas, J. (1998). The Normative Theories of Business Ethics: A Guide for the Perplexed. Business Ethics Quarterly, 8 (1), 19-42.

Hope, O.K. (2003). “Disclosure Practices, Enforcement of Accounting Standards and Analysts‟ Forecasts Accuracy: An International Study”. Journal of Accounting Research, 41 (2), 273-272.

Johnston, D. and Rock, S. (2005). “Earnings management to minimize superfund clean up and transaction costs”. Contemporary Accounting Research, 22 (3), 617-642.

KPMG (1996). International Survey of Corporate Responsibility Reporting 2006. Amsterdam: KPMG International.

Lang, M. and Lundholm, R. (1996). “Corporate Disclosure Policy and Analyst Behaviour”. The Accounting Review, 71 (2), 467-492.

Lars, H. and Henrik, N. (2005). “The Value Relevance of Environmental Performance”. European Accounting Review, 14 (1), 14.

Mackinlay, A. C. (1997). “Events studied in economics and finance”. Journal of Economic Literature, 35, 13-39.

McGuire, J. B. and Sundgren, A. (1988). “Corporate Social Responsibility and Firm Financial Performance”. Academy of Management Journal, 31(4), 854-872.

Mills, D. and Gardner, M. (1984). “Financial Profiles and the Disclosure of Expenditures For Socially Responsible Purposes”. Journal of Business Research, December, 407-424.

Murray, A. (2010). Do Markets Value Companies’ Social and Environmental Activity? An Inquiry into Associations among Social Disclosure, Social Performance and Financial Performance. An Unpublished Ph.D Thesis submitted to the Department of Accounting and Finance, University of Glasgow, UK.

Murray, A., Sinclair, D., Power, D. and Gray, R. H. (2006). “Do Financial Markets Care About Social and Environmental Disclosure? Further Evidence and Exploration from the U K”. Accounting, Auditing and Accountability Journal, 19 (2), 228-255.

Ness, K. and Mirza, A. (1991). Corporate social disclosure: A note on a test of agency theory. British Accounting Review, 23, 211-217.

Neu, D., Warsame, H. and Pedwell, K. (1998). “Managing Public Impressions:Environmental Disclosures in Annual Reports”. Accounting, Organizations and Society, 23 (3), 265-282.

Patten, D.M., (2002a). “The Relation between Environmental Performance and Environmental Disclosure: A Research Note”. Accounting. Organizations and Society, 27, 763-773.

Porter, M. E. and Linde, C. (1995). “Toward a new conception of the environment-competitiveness relationship”. Journal of Economic Perspective. 9 (4), 97-118.

Rajapakse, B. and Abeygunasekera, A. W. J. C, (2006). Social Reporting Practices of Corporate Entities in Sri Lanka. Retrieve from archive.cmb.ac.lk/research/ bitstream/70130/1616/1/6.pdf.

Richardson, A. J. and Welker, M. (2001). “Social Disclosure, Financial Disclosure and Cost of Capital”. Accounting, Organizations and Society, 26(7/8), 597-616.

Roberts, C. B. (1992). “Determinants of Corporate Social Responsibility Disclosure: An Application of Stakeholder Theory”. Accounting, Organizations and Society, 17 (6), 595-612.

Roe, M. J. (2003). Political Determinants of Corporate Governance. Oxford University Press: New York.

Scott, T. (1994). “Incentives and Disincentives for Financial Disclosure: Voluntary Disclosure of Defined Benefit Pension Plan Information by French Firms”. The Accounting Review, 69 (1), 26-43.

Solomon, J. F. (2005). From the Erotic to the Corporate: A Giddensian View of Trust Between companies and their stakeholders. Working Papers, Cardiff Business School.

Suchman, M. C. (1995). “Managing legitimacy: Strategic and institutional approaches”. Academy and of Management Review, 20(3), 571-610.

Tilt C.A (1999). The content and Disclosure of Australian Environmental Polices. Available at http:www.socsci.flindeis.edu.au/business/research/papers/ 99-4.htm. accessed on July 17, 2013.

Turban, D. B. and Greening, D.W. (1997). Corporate social performance and organizational attractiveness to prospective employees”. Academy of Management Journal, 40 (3), 658-672.

Ullmann, A. E. (1985). “Data in Search of a Theory: A Critical Examination of the Relationship among Social Performance, Social Disclosure and Economic Performance of Us Firms”. Academy of Management Review, 10 (3), 540-557.

Unerman, J. and O’Dwyer, B. (2004). “Theorising CSR/CSD as a Hegemonic Risk Discourse”. Paper presented at the International Congress on Social and Environmental Accounting, Dundee, September 1.

Uwuigbe, U. and Olayinka M. U. (2011). Corporate Social and Environmental Disclosure in Nigeria: A Comparative Study of the Building Material and Brewery Industry. International Journal of Business and Management, 6(2).

TRANSFER OF COPYRIGHT

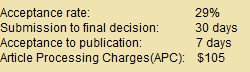

JRBEM is pleased to undertake the publication of your contribution to Journal of Research in Business Economics and Management.

The copyright to this article is transferred to JRBEM(including without limitation, the right to publish the work in whole or in part in any and all forms of media, now or hereafter known) effective if and when the article is accepted for publication thus granting JRBEM all rights for the work so that both parties may be protected from the consequences of unauthorized use.