Effficiency of Rural Community Banks in Ghana: An Application of Data Envelopment Analysis

Abstract

Rural financial markets in Ghana remain underdeveloped, largely because of the legacy of glaring failures in government-led programs. The basic functions of rural banks in Ghana are the mobilization of savings and the extension of credit to deserving customers in their areas of operation. Through their financial intermediation roles, rural banks act as catalysts for economic development in rural Ghana. Despite their role in the Ghanaian context, these banks have not been the subject of academic studies. The purpose of the study is to measure the efficiency and performance of the rural banks using Data Envelopment Analysis (DEA). The use of DEA is demonstrated by evaluating the management of 137 rural community banks in Ghana for the period 2004 to 2014. The estimation process explicitly, modelled for all the parameters especially efficiency using the non- parametric Data Envelopment Analysis (DEA). ROA was used as a performance measurement. The study pleaded in favor of investment to total asset, the total operating expenses to total asset and loan to total asset; and to be the main drivers to rural banks profitability measurement in Ghana since they were significant. The study registered liquidity (LIQ), total asset and inflation to be insignificant. The DEA results reveals 92.70% of RCBs to be inefficient. For RCBs to be more efficient and profitable the RCBs must strengthen effective credit administration by way of credit appraisal, monitoring the progress of loans and their efficient recovery. Important policy implications of these findings include the need to enhance confidence in the Ghana’s rural banking system, to encourage savings in regional rural banks, and to ensure efficient transfer of resources from savers to investors.

Downloads

References

Abdin, Z, 2007, Kinerja Efisiensi Pada Bank Umum, Proceeding Pesat (Psikologi,Ekonomi, Sastra, Arsitek & Sipil) Vol. 2, Issn : 1858 – 2559

Andah D O, Steel WF (2003). Rural and microfinance regulation in Ghana: Implications for development and performance of the industry, Africa Region Working Paper Series No 49. Washington, DC World Bank.

Beck, T. and Hesse, H., (2006). “Bank Efficiency, Ownership and Market Structure: Why are

Interest Spreads So High in Uganda?” World Bank Policy Research Working Paper 4027,

October 2006.

Bencivenga, V. R. & Smith, B. D. (1998). Economic development and financial depth in a model

with costly financial intermediation. Research in Economics, 52, 363-386.

Charnes, A. Cooper, W. W., and Rhodes, E. (1978). Measuring efficiency of decision making units. European Journal of Operations Research 2, 429-44.

Dabla-Norris, E., Floerkemeier, H., (2007). “Bank Efficiency and Market Structure: WhatDetermines Banking Spreads in Armenia?” IMF, Working Paper 07/134.

Demirguc-Kunt, A., Laeven, L., Levine, R., (2004). “Regulations, Market Structure, [7] Institutions, and the Cost of Financial Intermediation,” Journal of Money, Credit and [7] Banking 36, 593-622.

Demirguc-Kunt, A. & Huizinga, H. (2000). Financial structure and bank profitability. World

Bank Policy Research Working Paper No. 2430, Retrieved June 28, 2007 from http://ssrn.com/abstract=632501.

Drury C. (2007). Management and Cost Accounting. London: Thomson Learning 6th Edition.

Eken, M.H. and Kale, S. (2011). Measuring bank branch performance using data envelopment analysis (DEA); The case of Turkish bank branches. African Journal of Business Management 5 (3) 889-901.

Frimpong J M (2010). Investigating efficiency of Ghana banks: A non-parametric approach.American Journal of Scientific Research (7), 64-76.

Halkos, G. E. and Salamouris, D. S. (2004). “Efficiency measurement of the Greek commercial banks with the use of financial ratios: a data envelopment analysis approach”, Management Accounting Research, (15) 201 – 224.

Hauner , David, 2004, Explaining Efficiency Differences Among Large German and

Austrian Banks, International Monetary Fund WP/04/140.

Hassan, M. K., & Bashir, A. H. M. (2003). Determinants of Islamic banking profitability. Paper presented at the10th ERF Annual Conference, Morocco, 16–18 December

Ho, T.S. Y. & Saunders, A. (1981). The determinants of bank interest margins: theory andempirical evidence. The Journal of Financial and Quantitative Analysis, 16(4), 581-600.

Fethi, M. D and Pasiouras, F. (2009). Assessing Bank Efficiency and Performance with Operational Research and Artificial Intelligence Techniques: A survey. University of Bath WP 2009.02.

Kablan, S. (2007). Measuring bank efficiency in developing countries: The case of WAEMU (West African Economic Monetary Union). Paper for African Economic Research Consortium.

Kediri, 2008, Rural Banks Efficiency and its Determinant, Office of Bank Indonesia Research report.

Khankhoje, D. (2008). Efficiency of Rural Banks: The case of India. International Business Research (2), 140-149.

Los Baños, J.A. (2007) Rural Banks, Resources Allocation Efficiency and Regional Economic Performance Philippine Management Review Vol. 14, 115-126.

Mohindra Versha and Kaur Gian (2012) Regional Rural Banks in India since Reforms: A Study of Technical Efficiency, Prerana, March.

Molyneux, P. Altunbas, Y. and Gardener, E. (1996). Efficiency of large banking. John Wiley Chichester 198. Oral M and Yolalan R (1990). An Empirical Study on Measuring Operating Efficiency and Profitability of Bank Branches. European Journal Operational, Research., 46(3):282-294.

Paradi J. C., Rouattb S., Zhu H (2010) Two-stage evaluation of bank branch efficiency using data envelopment analysis. Omega. 39(1): 99-109.

Portela, M., & Thanassoulis, E. (2007). Comparative efficiency analysis of Portuguese bank branches. European Journal of Operational Research, 177(2), 1275-1288.

Resti, A. (1997). Evaluating the cost-efficiency of the Italian banking system: what can be learned from the joint application of parametric and non-parametric techniques. Journal of Banking and Finance, 21 (2), 221-50.

Robison, L.J., and P.J.Barry."Portfolio Adjustments:An Application to Rural Banking." Amer. J. Agr.Econ.59(1977):311-12.The Competitive Firm's Response to Risk. NewYork: Macmillan Co., 1986.

Sathye, M. (2001). X-efficiency in Australian banking: an empirical investigation. Journal of Banking and Finance, 25. 613-630.

Sherman, H. D. and Gold, F. (1985). Bank Branch operating efficiency: Evaluation with data envelopment analysis. Journal of Banking and Finance, 9 (2). 297-315.

Soteriou, A., & Zenios, S. (1999). Using data envelopment analysis for costing bank products. European Journal of Operational Research, 114(2), 234-248.

Schaffnit, C., Rosen, D., & Paradi, J.(1997). Best practice analysis of bank branches: an application of DEA in a large Canadian bank. European Journal of Operational Research, 98(2), 269-289.

Sufian F. and Chong R.R., (2008). “Determinants of bank profitability in a developing economy: empirical evidence from the Philippines”. Asian academy of management journal of accounting and finance; AAMJAF, 4, (2), 91–112.

Taylor, W., Thompson, R., Thrall, R. , & Dharmapala, P. (1997). DEA/AR efficiency and profitability of Mexican banks a total income model. European Journal of Operational Research, 98(2), 346-363.

Tesfamariam , K.,Tesfay, H. and Tesfay, A. (2013) Relative Efficiency of Rural Saving and Credit Cooperatives: An Application of Data Envelopment Analysis International Journal of Cooperative Studies 2, (1), 16-25.

Westhuizen, G, (2007), Estimating Technical And Scale Efficiency Of Banks Using

Balance Sheet Data: A South African Case, wrking paper, School for Economic Sciences North-West University Vaal Triangle Campus, Vanderbijlpark , South Africa.

Yue, P. (1992). Data envelopment analysis and commercial bank performance with application to

Missourie Banks, Federal Reserve Bank of St Louis Economic Review, January/February, 31-45.

TRANSFER OF COPYRIGHT

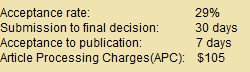

JRBEM is pleased to undertake the publication of your contribution to Journal of Research in Business Economics and Management.

The copyright to this article is transferred to JRBEM(including without limitation, the right to publish the work in whole or in part in any and all forms of media, now or hereafter known) effective if and when the article is accepted for publication thus granting JRBEM all rights for the work so that both parties may be protected from the consequences of unauthorized use.